Mortgage Broker - Truths

Wiki Article

The smart Trick of Mortgage Broker Assistant Job Description That Nobody is Talking About

Table of ContentsThe Single Strategy To Use For Mortgage Broker Job DescriptionThe Basic Principles Of Broker Mortgage Meaning Mortgage Broker Salary Fundamentals ExplainedBroker Mortgage Rates Fundamentals Explained6 Simple Techniques For Mortgage Broker AssistantGet This Report on Broker Mortgage FeesThe Main Principles Of Mortgage Broker Salary The smart Trick of Mortgage Broker Assistant Job Description That Nobody is Talking About

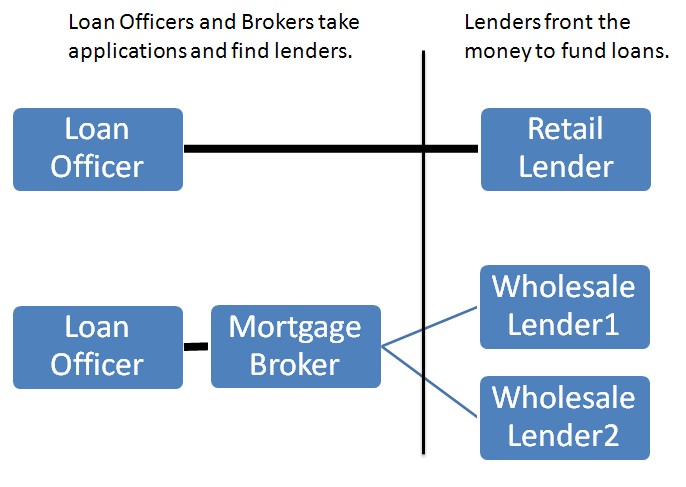

What Is a Home loan Broker? A home loan broker is an intermediary between a banks that offers finances that are secured with realty as well as people curious about purchasing actual estate who need to borrow money in the form of a financing to do so. The home mortgage broker will certainly collaborate with both parties to get the individual approved for the loan.A home mortgage broker usually works with many different lenders and can use a selection of funding choices to the debtor they function with. The broker will collect info from the private as well as go to several loan providers in order to discover the best potential loan for their client.

Mortgage Broker Assistant Things To Know Before You Get This

The Base Line: Do I Required A Home Mortgage Broker? Dealing with a home loan broker can save the consumer time and initiative during the application procedure, and potentially a great deal of money over the life of the car loan. Furthermore, some loan providers function specifically with home mortgage brokers, suggesting that borrowers would certainly have accessibility to loans that would or else not be available to them.It's important to examine all the fees, both those you might have to pay the broker, as well as any type of charges the broker can assist you prevent, when considering the choice to deal with a home mortgage broker.

Mortgage Broker Assistant - An Overview

You have actually most likely heard the term "mortgage broker" from your property agent or buddies that have actually acquired a residence. What specifically is a home mortgage broker and what does one do that's various from, say, a funding policeman at a financial institution? Nerd, Wallet Guide to COVID-19Get responses to questions concerning your home loan, traveling, financial resources and keeping your satisfaction.1. What is a home loan broker? A mortgage broker acts as a middleman in between you and prospective loan providers. The broker's task is to contrast home loan loan providers on your behalf and discover rates of interest that fit your needs - mortgage brokerage. Home loan brokers have stables of lenders they deal with, which can make your life easier.

10 Easy Facts About Broker Mortgage Near Me Shown

Just how does a mortgage broker make money? Mortgage brokers are usually paid by lenders, in some cases by debtors, however, by regulation, never both. That law the Dodd-Frank Act Prohibits home mortgage brokers from charging surprise costs or basing their compensation on a debtor's interest price. You can also pick to pay the home mortgage broker on your own.The competition and home costs in your market will certainly have a hand in determining what home loan brokers cost. Federal legislation restricts how high settlement can go. 3. What makes home loan brokers various from car loan police officers? Lending police officers are employees of one lender that are paid established wages (plus incentives). Car loan police officers can compose just the sorts of finances their company chooses to offer.

The Best Strategy To Use For Mortgage Broker

Home mortgage visit site brokers may be able to offer debtors access to a wide selection of funding types. You can save time by utilizing a home loan broker; it can take hours to apply for preapproval with different loan providers, then there's the back-and-forth interaction included in financing the loan as well as making certain the deal remains on track.When choosing any kind of lender whether through a broker or directly you'll want to pay interest to lender costs." Then, take the Loan Price quote you obtain from each lending institution, position them side by side and also contrast your passion price and all of the costs and closing prices.

Excitement About Mortgage Broker Vs Loan Officer

5. How do I pick a home loan broker? The most effective method is to ask close friends as well as family members for references, however make certain they have really used the broker and aren't just going down the name of a previous college roomie or a remote associate. Learn all you can concerning the broker's solutions, communication style, degree of expertise as well as technique to customers.

The Best Guide To Mortgage Broker Meaning

Competitors and also home rates will affect just how much mortgage brokers make money. What's the difference in between a home loan broker and also a funding police officer? Mortgage brokers will deal with many loan providers to discover the most effective finance for your circumstance. Finance officers function for one lender. How do I find a home loan broker? The very best method to discover a home loan broker is via references from family, pals and your realty agent.

Mortgage Brokerage Fundamentals Explained

Acquiring a brand-new home is among one of the most intricate occasions in a person's life. Residence vary considerably in terms of design, amenities, college area and, naturally, the constantly essential "place, area, location." The home loan application process is a challenging facet of the homebuying process, specifically for those without past experience.

Can identify which concerns may develop difficulties with one lender versus an additional. Why some purchasers avoid home mortgage brokers Often homebuyers really feel more comfy their explanation going directly to a huge bank to secure their loan. In that instance, customers need to a minimum of consult with a broker in order to recognize every one of their alternatives pertaining to the sort of loan and also the readily available rate.

Report this wiki page